|

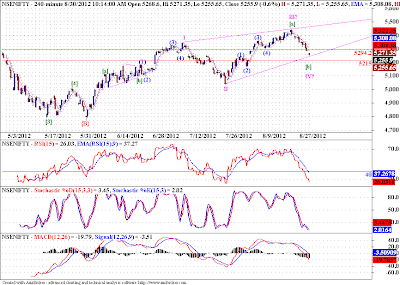

| 4 Hourly Chart |

Nifty is bang in the middle of the support zone. Whats in store for us, only time will tell. But the risk reward scenario for a possible up move from this zone is getting favorable. Below 5215-5200 levels, the long trade will start losing credibility. And to go short we will first require a clear 3 wave pullback to this down move. The reason I am in favor of long trade (till we don't break the said support zone) is because the current fall resembles the fall marked by wave II on the chart above, and it has been observed that alternation is conspicuously missing in waves II and IV of an ending diagonal.

But one cant argue with the markets, and contrary to the expectations of "certainty" fascinated market participants, we have to be ready for adverse market action. Hence the "alternate count" (discussed in last post), which is as good as a "boon" given by EWP to traders.

No comments:

Post a Comment

...I am thrilled to learn what you think about this piece of content...