|

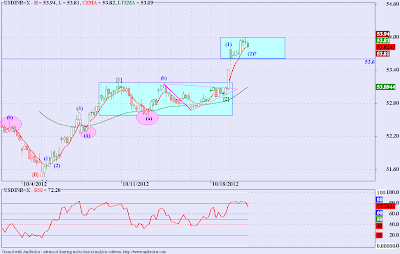

| 10 Y GOI Bond |

|

| Nifty |

I was looking at the 10Y GOI Bond Yield Chart. Earlier I was expecting the rates to rise, but rates have just flattened since then. But then it struck me that the pattern that the Nifty is forming is strikingly similar to what the 10Y Yield has be forming. Also the pattern looked like a classical chart pattern Head and Shoulders. Now in the crash of 2008 in India bonds also crashed hard. I am expecting that the current rise in Nifty is of corrective nature, and at this point in time there is not evidence to suspect that we wont fall.

Of course classical chart patterns fail often, and I am not an expert in their interpretation at all. But still I feel this information was worth sharing. Please refer the charts below for similar behaviors of Nifty and 10Y Bond.

|

| 10 Y GOI Bond Crash |

|

| Nifty 2008 Crash |