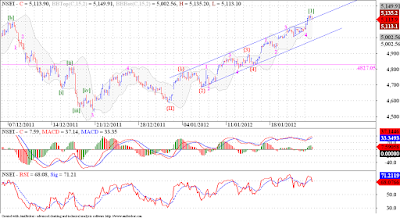

Nifty staged a magnificent rally today. I was warned by one of the well wishers about an irregular correction in Nifty ending at 5070 levels. And truly market has snapped back from those exact levels. But since wave [2] was a zigzag, and deep, we should get a flattish wave [4], if indeed wave [3] is done. And since yesterday we have one 3 wave downmove followed by a 3 wave upmove today, akin to a developing flat or a triangle. Today's rally if continues tomorrow, will turn into a new impulse wave, but if we are forming a flat or a triangle in wave [4] we should move down from current levels, either in 5 waves in case of a flat or 3 waves in case of a triangle. So tomorrows price action holds the clue for Nifty in near term. I am for a downmove from current levels, but nobody's above the markets!

Tuesday, January 31, 2012

Monday, January 30, 2012

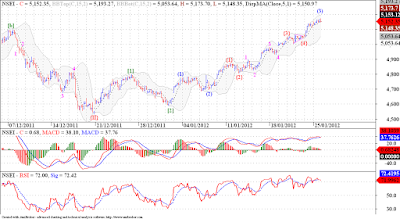

Banknifty also seems to have completed the wave [3] and is undergoing a correction in wave [4]. The preceding wave (4) range comes at 9115 - 8813, so once we break the 9456 level we are sure to test this band. Also an important thing to mark here as well as on Nifty is that MACD is not showing divergence, and made a new high consistent with the wave [3] development. So once complete this correction and turn back up again, we might form a good negative divergence on waves [3] and [5], to complete wave I.

Nifty turned down today, and as mentioned earlier we are forming wave [4] of this impulse move, in wave I. So I am looking for support around 5040 - 5000 levels. The corrective pattern at this stage looks like a zigzag, but this being a wave [4] we cannot be too sure, first three wave move may give rise to a flat or a triangle. The upside target for this wave I is around 5400 levels, so there is some more upside left still. Look for reversal signals in 5040 - 5000 band.

Nifty turned down today, and as mentioned earlier we are forming wave [4] of this impulse move, in wave I. So I am looking for support around 5040 - 5000 levels. The corrective pattern at this stage looks like a zigzag, but this being a wave [4] we cannot be too sure, first three wave move may give rise to a flat or a triangle. The upside target for this wave I is around 5400 levels, so there is some more upside left still. Look for reversal signals in 5040 - 5000 band.Kindly refer my daily and weekly count to get my count on the bigger picture.

http://tradeelliottwave.blogspot.com/p/nifty-weekly-count.html

http://tradeelliottwave.blogspot.com/p/nifty-daily-count.html

http://tradeelliottwave.blogspot.com/p/nifty-weekly-count.html

http://tradeelliottwave.blogspot.com/p/nifty-daily-count.html

Sunday, January 29, 2012

This is my attempt at long term analysis of USDINR.

Looking at the bullish picture that is emerging in Indian equities, I have labelled two scenarios one which is ultra bullish for INR and another where the rally in INR will be limited to 44 - 42 range.

Case I : USDINR completed an impulse in 2002, and since then we are forming a huge 'irregular flat' pattern, the waves (A) and (B) are done, and now we are embarking on wave (C) of that correction which should be especially severe on Dollar against the Rupee. Rupee will stage a big rally and may target the price area around 34 - 33 range. This may sound a bit audacious at this juncture but one must be mindful of the fact that Elliott waves are fractal in nature, and play out in the same manner no mater what the time frame under consideration.

Case II : This alternate scenario is marked with wave labels followed by a question mark, but I am not sure of the probabilities associated with these count, so at this stage I am considering both of them equiprobable. Now as per our alternate count, what ended in 2002 was actually the wave (III) of this big rally in USDINR, and we completed wave (IV) in 2008, what occurred during 2008 - 2009 was wave {I} of the wave (V) of this big impulse wave. Following wave {I} we formed waves A and C of an irregular flat correction, and are now falling in wave C of {II} and should find support around 44 - 42 levels. This scenario may not be as bad for USDINR as case I.

Obviously Case I is very bullish for Indian equities, whereas Case II is bullish in the short term but will prove bearish in the medium to long term. I would like to draw your attention to a recent development, where India and Iran have entered into a pact, according to it Indian will buy Crude-oil from Iran but will pay them in GOLD not Dollars. Can this be the start of major economies fueled by domestic demand and not credit expansion, rejecting the Greenback as the globally accepted medium of exchange. As always only time will tell.

Friday, January 27, 2012

Nifty is still in the extending third wave and I am expecting a couple of more new highs in this up move on daily scale. On lower time frame, hourly, we may expect a couple of more highs on hourly too. We may get prices in the range of 5225 - 5290 for wave (3). I know the range is a bit wide, but right now all I am sure of is we may get a couple of more highs before we get a meaningful correction in wave (4). And the extent will be around 5000 levels, the end of previous wave {4}. Also the wave (4) down should bring the MACD to 0 level.

Thursday, January 26, 2012

I could only gather limited data for CAD INR, But what I could spot from this chart is a possible zigzag correction nearing an end. We also have an ending diagonal in wave C. But since I don't have a longer term price data for this pair I cannot put into perspective this particular price move. We can spot persistent negative divergences on MACD and RSI. If we cross the 48 level on the downside, we may see further falls on this chart.

Wednesday, January 25, 2012

This is the chart which was posted on 9 Dec 2011, please refer the post here. We said there were two possibilities on DX one of an extended up move, and one that of a triangular consolidation. In the 'triangular consolidation' view, we had a possibility of wave E either completed or one more up leg possible to finish it. In today's post I am giving a chart which suggests a possible DZZ in wave E of {B} before an extensive down slide begins from here.

This adjacent chart shows that DZZ formation. We might correct right now till 78.25 - 77.40 levels, to complete wave (b) and then rise one more time to complete the wave [c] of this DZZ correction. What may happen only time will tell, but its always good to have a few road maps the prices may take in due course of time. Our other two vies of the post on 9-12-11 are still in play.

Nifty has eluded us since last couple of weeks, and thats probably because we are in a bull trend already. I have given up forcing market as per my count, and have tried to see what market is telling us, and the chart besides shows what I think market is telling us. We are extending in wave (3) of [3]. Once this wave (3) is done, we may see a brief correction to 5040, only to resume wave [5] up. The 261.8% projection of wave [1] comes around 5300 levels, i feel the probable target for this whole up move in wave I may reach this area around 5300. Kudos to those who were adamant bulling during this rally.

Tuesday, January 24, 2012

|

| Hourly chart |

Nifty broke above the upper channel line but around the close it came down and closed below the channel line, typical development for a 5th wave extension, called a 'throw over'. Such a development suggests an end to the impulse wave under consideration, but will Nifty follow our analysis? That remains to be seen. But if we have completed this 5 wave move, with wave {5} extension then we can expect the correction to this move reach rapidly to the wave 2 of extended wave {5}, and further to the wave {4} of this impulse wave, the range comes around 4900 - 4800 levels. Let us now observe if we get the next 300 odd points to the down side, stop loss for any shorts should be above today's high. Below 4850 this view gets added confirmation.

Monday, January 23, 2012

Nifty is rising in a channel, the Elliott Wave count suggests that we might have completed and once prices break the channel, we can conclude that prices are returning at least to the previous wave {4}around 4825 levels. If we break 4825 then we might have to think that possibility of a new low remains. But if we get supported around 4825 then we may see much higher prices. But in immediate future we might see prices coming down, of course RBI must help us by not cutting the rates. Lets see whats in store for us!

Friday, January 20, 2012

|

| Daily Chart |

This daily chart of Banknifty shows unlike Nifty Banknifty has completed the TZZ correction. Now it is ready to start a big up move, and the recent price action supports our view.

But according to EWP once a 5 wave up move is complete we get a corection to that upmove. And this stupendous rise in Banknifty is very close to completing the 5 wave advance, check the hourly chart below.

|

| Hourly Chart |

In this chart we can see that currently we are forming an extension in wave (5) of this 5 wave upmove. And once complete should be subjected to a sharp correction owing to the extension in the wave (5). The (a) wave of this correction will reach the low of wave {2} of the extending wave (5). And then after a corrective advance wave (c) should resume. Since we expect Nifty to make a new low, this correction should be deep in case of Banknifty. Lets see how things pan out in near future, but Banknifty bulls beware.

|

| Hourly Chart |

Iam trying a different count today. Please read this hourly chart in conjunction with the weekly and daily charts which have been updated today.

I feel Nifty may have formed a failed {c} wave in (b). And the rise towards the 5100 levels is the (c) wave of an irregular flat correction in wave [b] of the third leg of the TZZ. Wave {2} of (c) of [b] was a sharp correction so expect wave {4} to be a sideways consolidation, a triangle or a flat, possibly. Look for the MACD to come down towards 0 level on wave {4}, and a final dash to the 5100 - 40 levels to conclude wave {5}and this up move. Only time will tell.

Wednesday, January 18, 2012

Updated Hourly Chart

Nifty meandered today at yesterdays levels, but closed down. If the top is in place for the short term then we should correct from here, to 4865 levels. Both the counts presented today (refer link above) call for a correction. So I expect prices to come down form here, and then we will take from there.

This is a weekly chart of USDCHF. And as we can see on the chart we have completed 5 wave down, the 5th wave ended with a spike down, which is a sign of prices rejecting such levels. As per EWP a 5 wave move is followed by a 3 wave retracement, so we might see the recent rise in prices extending towards the 3 fibo levels marked on the chart. The pattern which the corrective rally will form cannot be foretasted at this point in time, but we can safely say that we are bound to see higher levels on this pair.

Tuesday, January 17, 2012

Tata Steel was consistently coming off from the top it made in April 2010, at the levels of 740 odd. It seems to have completed the mandatory 3 waves, a minimum requisite for a correction. Also this 3 wave move ended around the 61.8% correction of the upmove. We have witnessed a sharp 5 wave move up from the point marked {II} on the chart which where we are contemplating an end to the correction. So unless this is some different pattern we cannot see yet, we are headed up from here!

This is a daily chart of Bharti. I have marked wave {D} in the middle top portion of the chart. This {D} is actually second last wave of a triangle. This triangle has been forming since 2007, so one can say that Bharti was in consolidation since approximately 4 years. Now wave {E} must be a 3 wave structure, and we can see that we have already completed waves A and B, now forming wave C of {E} of (IV). We might form a triangle in wave [4] of C of {E}. Once this wave [4] and [5] are done we will get a sharp thrust which will be coming out of a 4 year long triangle. So it will be worth waiting for.

|

| Weekly |

Infy posted bad results and corrected sharply as a reaction to the news. But can this be a classic opportunity to accumulate Infy for a rally close to all time highs if not above them. Well if EWP patterns are to be believed then we have a glimmer of hope that we might see the stalwart of D street back to its full glory, before the gory bear market takes its tall on it.

|

| Daily |

What I see on the charts is that from Jan - Aug 2011 we saw a 3 wave fall in wave (A) of an irregular flat correction. Then we have rallied 3 months close to 2970 levels. From this level we have completed a flat correction where wave C was effected by the bad guidance Infy posted for 2012. But looking at the chart we don't see how 2012 can be bad for Infy, if the recent lows around 2555 is protected then we may see a rally moving sharply up when markets are positive but with shallow corrections when the market is not doing too well. Is this really possible, well if we really believe what we see, then it is. But Bolton found it difficult to believe what he saw, then we cannot pressure ourselves too much, can we? :)

Nifty Hourly Count Continuous Chart

I have also included 'hourly count' for nifty along with weekly and daily counts. And according to the hourly count on Nifty we can spot two possibilities, please follow the link above for charts.

One of the possibilities is that of an irregular flat correction in wave [b] of wave Z of the TZZ. In that case Nifty should atleast test the high of wave (a) around 5100 levels. Then it should come down sharply in wave [c] of Z.

Second count suggests that we are forming a triangle in wave [4] of wave I down. Now the if this works out then we may see Nifty rallying above the 5100 levels towards the 4175 mark, all we want in this count is that wave (e) of [4] should not go above the levels of 5175, which is the low of wave [1], as per the rules of impulse waves in EWP. This formation will take some time to develop, but with the ending diagonal scenario not remaining feasible, the next best count is that of a triangle n wave [4].

I have also included 'hourly count' for nifty along with weekly and daily counts. And according to the hourly count on Nifty we can spot two possibilities, please follow the link above for charts.

One of the possibilities is that of an irregular flat correction in wave [b] of wave Z of the TZZ. In that case Nifty should atleast test the high of wave (a) around 5100 levels. Then it should come down sharply in wave [c] of Z.

Second count suggests that we are forming a triangle in wave [4] of wave I down. Now the if this works out then we may see Nifty rallying above the 5100 levels towards the 4175 mark, all we want in this count is that wave (e) of [4] should not go above the levels of 5175, which is the low of wave [1], as per the rules of impulse waves in EWP. This formation will take some time to develop, but with the ending diagonal scenario not remaining feasible, the next best count is that of a triangle n wave [4].

Monday, January 16, 2012

|

| Daily Chart |

Hero Motors was mentioned to me by a dear friend. It seems that we prices have completed an important 5 wave advance in Sep 2001. Since then prices have traced out an irregular flat correction, in which wave C is 161.8 % of wave A. Also 5 waves seems to be complete in wave C of {II}. Now Hero Motors should go up from here in wave {III}. This is a beautiful chart.

Sunday, January 15, 2012

USDINR is correcting after a sharp rise from the 43 - 44 levels right until 54 odd levels. The long tern count suggests that we might have completed a wave III advance at the point marked as "Significant Top" on the chart. Or as the wise men have warned against "calling an end to a 3rd wave advance", this might just be wave (1) of an extending wave [5] of III. All this might confuse the reader, but to put it simply, if USDINR takes support and starts rising from the levels of 51 - 50 we might see a protracted rally in the near future. But if we break the 51 - 50 level band then we might easily see the correction extending to 49 - 48 levels. All this of course will depend on how the Dollar behaves.

|

| EURUSD |

We might be close to a bottom on EURUSD. But that is true if our count plays out. There has been persistent positive divergence on EURUSD on many time frames. Its high time they made their presence felt.

If we break below the lower boundary of the falling wedge pattern the down trend may extend.

A nice video about the debt limit extension by USA, and the proposed spending cut to "REDUCE" the overall debt limit!

Saturday, January 14, 2012

I am presuming May 2006 top in copper as a significant top. The price action followed by the top is clearly corrective till date. We completed wave A in Dec 2008, and wave B in Jan 2011. Since then the price action is very confusing to say the least. But we can still count the fall as a five wave move. Thankfully no EWP rule is violated. Now following the wave (5) failure in [1] and retracing a zigzag in wave [2]. Wave (c) of [2] tracing out a possible ending diagonal. Once this pattern completes we will see wave [3] down, and that should be really dramatic.

I am presuming May 2006 top in copper as a significant top. The price action followed by the top is clearly corrective till date. We completed wave A in Dec 2008, and wave B in Jan 2011. Since then the price action is very confusing to say the least. But we can still count the fall as a five wave move. Thankfully no EWP rule is violated. Now following the wave (5) failure in [1] and retracing a zigzag in wave [2]. Wave (c) of [2] tracing out a possible ending diagonal. Once this pattern completes we will see wave [3] down, and that should be really dramatic.Friday, January 13, 2012

Nifty invalidated our 'Leading Diagonal Pattern' today, but that does not mean our bearish view on market is invalidated too. Our bearish view is still valid and let us see what possibilities markets have in store for us.

1. We may have completed a 5 wave move in wave {c} of (4). If this scenario plays out we will fall hard tomorrow and at least effect some retracement of this 5 wave up move in wave {c} of (4). And if we take out 4780 levels on the down side then we are in for much bigger falls. Right now 4780 is critical and we have to watch the prices around this level..

1. We may have completed a 5 wave move in wave {c} of (4). If this scenario plays out we will fall hard tomorrow and at least effect some retracement of this 5 wave up move in wave {c} of (4). And if we take out 4780 levels on the down side then we are in for much bigger falls. Right now 4780 is critical and we have to watch the prices around this level.. 2. We may not have completed the wave 4 of {c} yet and may be forming an 'irregular flat' pattern. If this pattern is forming then we will see prices coming back to the area of 4800 - 4780 levels tomorrow in wave [ci] of 4 of {c}. And will move back up to complete the wave 5 of {c}, if we get support for prices in this range. This is our alternate count, but is possible.

But there are factors which support the first view of 'bigger falls', as MACD has made a divergence as well as a bearish hook on hourly chart. Also RSI is showing negative divergence. So this will cause some pressure on the prices. Now we have to watch the prices tomorrow with these two possibilities, and if Nifty takes out 4915 - 35 range on the upside tomorrow with confidence then we might conclude that this bearish view of mine needs to be reevaluated.

Thursday, January 12, 2012

Nifty consolidated today. But in that consolidation it may have formed a rare pattern, that of an "expanding leading diagonal", this pattern is typical at the start of major bear markets. If this is to be believed then we are in for a major crash tomorrow, or day after, once the consolidation in wave 2 is done with. Meanwhile Banknifty is shown stupendous strength, and may skew the patterns in Nifty. So please maintain your stop losses in Nifty, above 4900 levels. This particular chart formation was not clear on hourly chart, hence I used the 10 min chart today.

Nifty consolidated today. But in that consolidation it may have formed a rare pattern, that of an "expanding leading diagonal", this pattern is typical at the start of major bear markets. If this is to be believed then we are in for a major crash tomorrow, or day after, once the consolidation in wave 2 is done with. Meanwhile Banknifty is shown stupendous strength, and may skew the patterns in Nifty. So please maintain your stop losses in Nifty, above 4900 levels. This particular chart formation was not clear on hourly chart, hence I used the 10 min chart today.Gold may have completed a very big corrective pattern here at [y], or we may be forming a leading diagonal in Gold, which will complete at I?. A third possibility not shown on the chart, is that of a series of 1-2/1-2 waves, and we can expect extreme falls once this 3 wave move is done. The current 5 wave move at (1) or (a) will be retraced by a 3 wave correction to (2) or (b), but if we keep on falling and take out the low of this 5 wave advance shown by [y] from these levels then its definitely a 1-2/1-2 formation, and then we may see much much lower levels on Gold.

IFCI is tanking for a long time now. But upon counting the waves since latest significant top we can see that IFCI has actually completed only 4 wave of the down move, to complete this down move we need another low in IFCI, and hopefully if Nifty falls from here we will get the same. A couple of possibilities are shown on chart.

Wednesday, January 11, 2012

Nifty as per my analysis may have topped today, but only market action can confirm it. I have marked may levels on the chart, we took support at 4841 and bounced back sharply, we might have formed an irregular correction in wave (ii). and once the base channel in green color is broken down we might correct sharply, and embark on wave (5) down.

Infy results are going to be declared tomorrow. The EW formation seen on the charts suggests, that we have completed an important degree advance at these levels. Observe a big negative divergence on waves 3 and 5. 2781 hold the key, for big downside. Hope tomorrows results help achieve this price action.

Tuesday, January 10, 2012

Nifty at a very critical juncture, if I look at Nifty through my analysis. In almost 10 years in markets I have learnt one thing, that you cannot take your knowledge very seriously. So if we just look at the chart of Nifty without any markings and drawings on it, it does not look much different.

So through my analysis, we can see we are just about to complete a zigzag correction and are very near the upper channel boundary. The range of 4860 - 4880 is very critical. If we break out from this level with a bang we will have to reconsider our count, else we are still within the boundaries of my count of wave (4) within an Ending Diagonal.

I feel my view of Nifty getting resisted around 4865 - 80 levels is gaining in credibility, and the additional confidence comes from the chart of Banknifty. We can observe a triangle in wave 4 of Banknifty in the adjacent chart. Also RSI is nearing the OB zone, MACD is setting up nicely for a negative divergence on waves 3 and 5. So if all this happens then we are very close to seeing a top, at least short term one on Banknifty, and Nifty though is forming a different pattern will not diverge too much from Banknifty. I feel a surprising BAD result from a couple of major companies may spook the markets.

Monday, January 09, 2012

Nifty may be forming a triangle in wave b and might complete the wave (4) with a thrust from the triangle. The target seems to be around 4865. Our ending diagonal seems to be in contention still. Again unless and until we cross the 4865 levels confidently we are firm on our ending diagonal scenario.

Nifty may be forming a triangle in wave b and might complete the wave (4) with a thrust from the triangle. The target seems to be around 4865. Our ending diagonal seems to be in contention still. Again unless and until we cross the 4865 levels confidently we are firm on our ending diagonal scenario. Triangle are very good patterns to trade, so keep and eye when it is about to complete, late in tomorrows trading day!

|

| Bullish View |

Dollar Index has multiple possibilities. One is a bullish, with a major bottom in place, as wave {I} and {II} seems to be complete. What is expected now is a dynamic advance in wave {III}. A rise in dollar is bearish for other asset classes and currencies (for us a very weak rupee ahead). But before we position ourselves for a stronger dollar lets examine alternate possibilities too.

|

| Bearish View |

An alternate bearish view on dollar can be contemplated as shown in adjacent chart. we can see a clear impulsive downmove complete and followed by a triangle formation, either complete or just abut to be completed according to the second count on chart, in which we are still forming wave E. But if the triangle was completed earlier, then we had a 5 wave move down, and a corrective upmove which is perilously close to the 61.8% retracement level of wave I down. If we get resisted at 82.591 levels then we may fall in wave III which should be especially dynamic.

Now I have purposefully avoided putting a target on both the counts as this being a weekly chart we will get enough time to act once either of our count proves right and gives us confirmation.

But given the precarious economic conditions in US and EU, I feel our bullish count should be our preferred count, and the bearish possibility should be used to prepare a backup plan.

I usually post my analysis EOD, but since markets have surprised us I thought I should post what is going on in my head, at this moment. Please remember this is my own view on Nifty and in no way a complete trading plan, so please follow your own trading plan only, and use my charts if they can be of any assistance.

Saturday, January 07, 2012

This is a graph of MCX Crude try and compare this with the on of International Crude, here. The MCX Crude chart and waves are a bit different. But we can be sure of the top being in place once we take out two important levels of 5247 and 4877. One caveat here though if we take out 5247 but fail to break 4877, we may have a remote chance of wave [5] extending, which is typical of commodities as rightly pointed out by Ranajay. Once below 4877 we may test 4500 levels on crude.

This is a graph of MCX Crude try and compare this with the on of International Crude, here. The MCX Crude chart and waves are a bit different. But we can be sure of the top being in place once we take out two important levels of 5247 and 4877. One caveat here though if we take out 5247 but fail to break 4877, we may have a remote chance of wave [5] extending, which is typical of commodities as rightly pointed out by Ranajay. Once below 4877 we may test 4500 levels on crude.This is a 1 min chart of the advance towards the closing of the markets. We can observe a leading diagonal and then a sharp rise ion wave [iii] of 5. There seems to be a triangle formation taking place in wave [iv], though I have marked it as complete, it my extend sideways and take more time to complete. One last dash towards the 4815 - 4865 range is required to complete this pattern. The minimum requirement is to cross the high of wave {a}. Once this is done we may expect this zigzag pattern to be complete and then look for the original down trend to resume. But getting so deep into such lower time frames sometimes takes our focus off the larger picture!

Friday, January 06, 2012

Nifty rose sharply from the support levels of 4690. Our wave 4 took form of an irregular flat. MACD also formed a clean zero level reversal. Now by using reverse fibonacci technique we can forecast the possible range for wave 5 from 4810 - 4850. Its still within our earlier resistance zone of 4800 - 4860. MACD is also setting up for a good negative divergence on wave 3 and 5. Next couple of days are going to be really interesting.

Banknifty has completed all the requirements of a zigzag correction. We can also count a 5 wave advance in wave {c} on a lower time frame. But on Nifty we have not yet crossed the top of wave {a}, the minimum requirement of a zigzag. But all the EWP rules and guidelines were formulated by observing the markets, not the other way round, so as always markets reign supreme, and we can only do well if we follow it. I believe Banknifty has tipped its hand and below 8294.35 we should fall hard.

So now it is interesting to observe whether Nifty pulls Banknifty up to complete the zigzag, or Banknifty just falls taking Nifty with it!

Nifty is roughly between a band from 4500 - 4800, try to short OB markets and but OS markets, till this range is resolved.

Thursday, January 05, 2012

Crude may have completed a 5 wave move. The last 5 wave advance is shown in greater detail on the hourly chart. Once this last wave [5] is done we may retrace back to the end of previous wave [4]. Within the wave [3] we had an extended wave (5), and hence the wave [4] retraced back to the area wave {2} of (5) of [3]. To confirm our view we have to trade below 98.25 levels, then we may continue the correction till we reach the levels of 92.70. I am expecting Crude to reach 114.80 levels in 3 wave to complete the wave {B} of a flat correction. So far we are on track. Right now I am looking for a downmove targeting the 92.70 area once 98.25 is taken out.

Crude may have completed a 5 wave move. The last 5 wave advance is shown in greater detail on the hourly chart. Once this last wave [5] is done we may retrace back to the end of previous wave [4]. Within the wave [3] we had an extended wave (5), and hence the wave [4] retraced back to the area wave {2} of (5) of [3]. To confirm our view we have to trade below 98.25 levels, then we may continue the correction till we reach the levels of 92.70. I am expecting Crude to reach 114.80 levels in 3 wave to complete the wave {B} of a flat correction. So far we are on track. Right now I am looking for a downmove targeting the 92.70 area once 98.25 is taken out.

Th hourly chart shows that we need to cross the high of wave {a} of the zigzag to complete the minimum requirement for a zigzag. That level is around 4800. Also on counting the recent advance after completion of wave {b}, seems to have completed 3 wave up, and now a consolidation in wave 4. We should get a thrust up in wave 5. But before that lets look at the 10 min chart. It suggests a couple of possibilities, one is that we have complete waves [i] and [ii] in wave 5 of {c}. We may just labor upwards to complete the wave 5, or we may drop sharply to complete a complex correction in wave 4 around 4690 levels and then start rising in wave 5. Both the possibilities look equiprobable, but the right look guideline and the guideline of alternation makes me favor the first possibility. But that's just my view I may be biased. So I suggest we wait it out rather than getting whipsawed and caught in a boring and frustrating consolidation. If 4860 is not taken out soon, the next big move will be on the downside. Always remember, patience is THE virtue.

This down move on EURUSD has been very difficult to count as per EWP rules and guidelines, at least I have found this to be very difficult. But the essence of EWP is to try and label the price moves in as many ways as possible and then select the count which satisfies all the rules and maximum number of guidelines. So as per my limited knowledge of EWP I have tried to label this down move on EUR USD, and unlike my earlier counts, this count suggests a DZZ forming on prices. The target for the wave [y] comes around 2500 levels by the guideline of equality, and it has already crossed the 61.8% projection mark of wave [w]. But there is another important level in between, i.e. of 78.6% projection of wave [w], that comes around the 2700 mark on EUR USD. This level also accommodates a possible ending diagonal similar to wave (c) of [w] in wave (c) of [y]. So I would refrain from calling an end to this down move yet, and would like to see some more clarity in patterns before forming a trading view on EUR USD.

Tata Motors is rising well after resolving a triangle in wave (4) as shown on the chart. Prices may be forming a big flat correction in TML. We completed the A wave, now rising in wave [a] of B. The target for this wave (5) of [a] should be between 208 - 225 range, preferably towards the higher boundary. After that we may come down in wave [b].

Natural Gas fell sharply from July 2008 in wave [a]. Then we rallied in 3 waves in wave [b]. Now again we are falling in 3 waves, this price development is similar to either a triangle in wave [b], or an ending diagonal in wave [c]. The targets for wave (3) of [c] is around 120 levels and the target for wave [c] should be around 105 levels. All in all we are looking at lower levels on Natural Gas from here.

Soybean was developing a big triangle since July 2008. The triangle has been forming for approximately 2 and half years now. And this patten seems to have completed in Oct 2011. The indicators also support the triangle formation. We are currently in wave (3) of the thrust which follows a triangle, and the primary target zone for wave (3) comes around 2790 - 2825 range. We might pause here for a while, but there is no doubt that Soybean is headed much higher from current levels.

![Natural Gas falling in possible Ending Diagonal in wave [c]!](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiwecZktCuM8D3Py2VWbONvffxxvH44JIl0ce6fHT6Gw7HxvmdJCmLuE3XhlrFruaGhcSjkn4fgRKI8x6W1aaf6xUVKcqftoblkqBaDZ6W2Krv3kf-l-C-DUTWfpaQ7Y7yeMdAFNPgX2DdY/s320/5-1-12+Natural+Gas+W.png)