Saturday, September 29, 2012

Tuesday, September 25, 2012

Wednesday, September 19, 2012

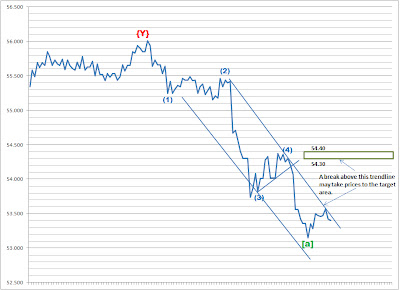

This is weekly chart for EURUSD. I am counting a double three correction in progress in EURUSD from the important low marked in the lower left corner of the chart. We may have completed 4 waves of the triangle formation in wave {Y}, and the current rise seems to be wave E of {Y}. There is a possibility that wave E might become more complex, but the resistance zone for wave E comes in the range of 1.3422 to 1.3688. I would be very cautious if we reach this level. The normal action point for a triangle is the break of trend line B-D, but since this is a weekly chart, I would like to look for reversal patterns on lower fractals once we reach the said resistance zone.

Saturday, September 15, 2012

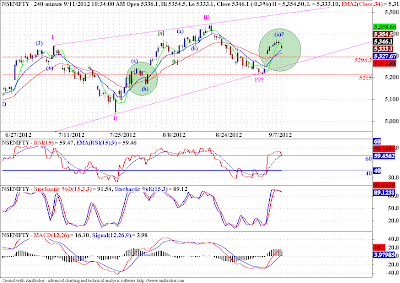

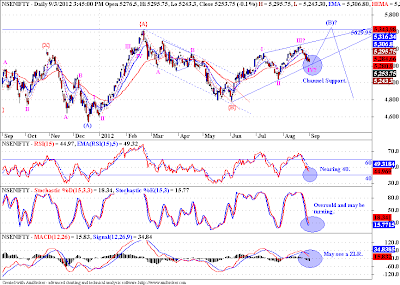

Elliott Wave Analysis of Nifty

Above is a weekly chart of Nifty. We can see that since the top of 2008 the market has been moving in corrective waves. Wave (A) bottomed in 2009. Then the market rallied albeit in corrective patterns, to the top in late 2010 completing wave (B). Now the price action post the wave (b) is interesting. We fell in wave {A} of (C) in a TZZ. The last leg being a triangle. This triangle formation has refuted the common belief of being a continuation pattern, but if we study Neely (thanks to persuasive EW analysis by Ranajay Banerjee), this was copy book. Now we should be rising in wave {B}, and the target seems to fall in the range of 5840 - 6100. We broke out of the triangle and also retested the [b]-[d] trend line, and moved back up. This virtually confirms the triangle has ended, and we should now rally towards the target zone, to complete wave {B}. Last week was very dynamic, and if we take out 5630 early next week we should see prices rallying hard till we reach 5840 to start with.

Elliott Wave Analysis of Commodities

Silver

This is a weekly chart of Silver. We can see that Silver was consolidating in a triangle pattern for quite some time, and if you pay close attention to wave (e) of the triangle, you can see that it was a triangle itself. This extreme contraction in prices always lead to stupendous breakouts. And that is what we are witnessing in Silver. The minimum target for this move would be 66900, which it has almost reached, and if the strength persists, which I think it would, then we may even see 75000 on silver. But this is a 5th wave, 3rd wave was extended without doubt, so we can expect 5th wave to be normal. The 75000 target in silver is calculated by the relation "thrust == widest part of the triangle". Keep on your toes when we reach 66900, if we breakout above it, there is a good chance we may see 75000 levels.

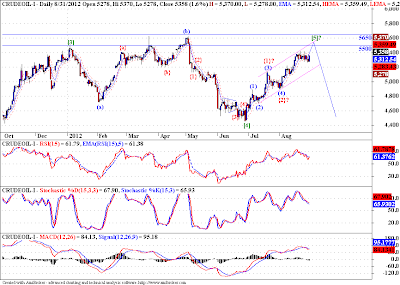

Crudeoil

This weekly chart of crude shows two possibilities. Concentrate on the 2009 lows, it has two labels marked on it. One label says that we completed wave (A), then the subsequent price action should be corrective, and has been labeled as such. We are counting an {A}-{B}-{C} in wave (B). Wave {C} is turning out to be a terminal pattern. IF this is the case then we should get resisted around 6000 levels and turn back to form wave (C). Another count a bullish one, suggests that we may have completed the correction at wave (C)? and Then we are forming wave {1}?-{2}?. In wave {2}? we may be forming a very bullish running correction, wave A? was a flat, so wave B? was strong , and wave C? is turning out to be a triangle. This count is very very bullish for crude, but for that we have to take out the 6000 levels first. I suggest keep on our toes if we reach 6000 on crude.

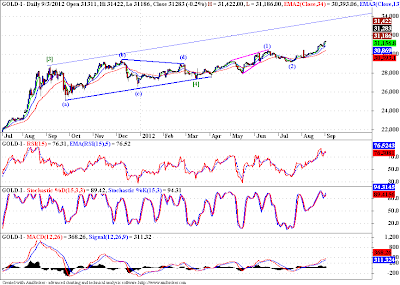

Gold

This is a daily chart of gold. Gold also like silver formed a triangle in wave [4]. But there is a difference in the patterns, the triangle in gold is rising one. The whole triangle is skewed upwards, suggesting strength in coming days. The breakout from the triangle looks sharp, and should continue for some time to come. The normal expectation for wave [5] is the widest part of the triangle, and that comes around 33400 levels on gold.

Elliott Wave Analysis of Currencies

USDINR

This is a weekly chaart of USDINR. We have a very important low at the left bottom corner of the chart marked wave (A). We have completd wave (B) in the top right corner of the chart. The pattern of wave (B) was that of a DZZ. The last leg of this corrective rise, wave Y was a TZZ. The last leg [z] of Y was a triangle, a terminal pattern. But if this count is true we have a potentially very bearish case on our hand.We have two options,

Option I - We form an {X} wave and then rise again. The {X} wave then should not go below 48.50 levels of wave {Y}. Form the 50-48.50 band we may resume up in wave {Z}.

Option II - If the corrective pattern is complete here, we may see deep retracement of this DZZ in wave (B), even complete retracement. This count will prove very bearish for USDINR, conversely very bullish for INR.

So in both the scenarios above the weakness is expected to continue, at least till the 50-48.50 band.

Dollar Index

This is a weekly chart of DI. We can see the price action from the significant top from the top left corner of the chart till wave label (W), looks like a triple zigzag (initially wrongly labelled as an impulse). The (X) wave was brief, and then we have see prices converging to form a triangle. the complete corrective pattern is of the form (W)-(X)-(Y), in which wave (Y) is forming a triangle. The target for wave {E} of (Y) comes in the range of 78.40-77.00, marked by two blue lines on the chart, above. Once we break above the {B}-{D} trend line, we can say that the triangle pattern is complete. What will follow if our count is right will be a huge rally in DI, which will be very bearish for other asset classes. There is a possibility that wave {E} may contract eve further in a triangle. This may lead to even stronger breakout.

Tuesday, September 11, 2012

|

| 4 Hourly Chart |

This might be a bit early, but I can see a similar looking pattern recuring on the chart of Nifty. The initial pattern ofcourse on the left side is circled in green, and the one mocking it is circled in green but on the right side. These are the salient points of similarities in these patterns,

1. LP - 13 DEMA crossed 34 DEMA RP - 13 DEMA corssed 34 DEMA

2. LP - Prices pulled back to EMAs RP - Prices pulling back to EMAs.

3. LP - RSI turned between 60-40 RP - RSI pulling back to 60-40 range.

4. LP - STS in OB zone, moving sdeways RP - STS in OB zone, moving sideways.

5. LP - MACD crossed 0, formed a hook RP - MACD crossed 0, hook not yet formed.

LP - Left Pattern, RP - Right Pattern, OB - Overbought

Note: Text marked in red suggests that the current pattern is not yet complete.

If there is any truth to the adage, "history repeats itself", then this constitutes a great example in the making. Though this is not a trading recommendation, just an observation, but since EWP is suggesting an up move, such stark similarities to previous price action with some compelling TA evidence, it is worth a shot.

|

| 4 Hourly Chart |

A contracting triangle is forming most probably in wave (b) of [4], as per our preferred count. I am suspecting the last two days strength in USDINR as wave {e} of (b) in the making. The possible target zone for this wave {e} ranges from 55.55-55.65. I would start looking for reversal patterns to the downside once we near this range.

This consolidation in USDINR has tested everybody's patience, and that is a good thing. Because once we get a resolution of this range, it should be nothing short of explosive, and yes tradable.

Monday, September 10, 2012

|

| Hourly Chart |

Banknifty, has it completed the wave (5) of [c] of II or not. Just making the readers aware of a possibility. Whereas Nifty does not lend itself to a new low, if our count is correct. But the possibility cannot be ignored in Banknifty. The last rise clearly is impulsive, so on the chart above it can either be wave {c} of (4) of [c] of II or wave (1) of [1] of III. How can we decide? Well by looking at the price action following the last rise. If its corrective in nature, we have a new up move on our hands, how ever if it cuts deep in the last rise, the potential up move will be delayed a bit.

I am bullish on Banknifty till we break the lower boundary of our support zone at 9675. I hope we don't have to go anywhere near that level. But its better to be prepared than pared.

|

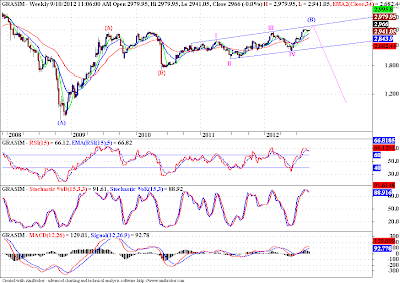

| Weekly Chart |

I have been following this particular count on Grasim, for quite some time now. I think if this count is correct, it is quite close to maturing. Mind you this a weekly fractal, so don't ump to conclusions as of yet. I am only suggesting that a very big pattern may be nearing completion. And I would look for signs of reversal in the 3160 - 3360 range.

This post can be taken as a gentle reminder to Grasim INVESTORS, that the risk reward to the long side is not favorable any more, and they should be on their toes should anything untowardly happen in this counter.

Saturday, September 08, 2012

|

| Gold Daily Chart |

The post triangle thrust is shaping up pretty well. Both the precious metals are expected to stay bid for quite some time now. There is not point to put a target to this up move. It is better keep following the trend, till we are rising in 5 waves and falling in 3. In case of Gold we are already above the minimum thrust measurement so we should be expecting a protracted wave [5]. For silver we are yet to cross the top of wave [3], that is the minimum target for wave [5]. But again its better to follow that predict.

EWP helps us achieve the golden mean, we can "anticipate", which lies beautifully between following and predicting.

|

| Silver Daily Chart |

|

| Daily Chart |

The daily chart of DI shows a clear DZZ corrective pattern completing around 84 levels, as discussed in last post. We are falling impulsively since. I had a bearish view on DI in which wave {B} was forming a running triangle. And we may be falling in wave {C} of the original {A}-{B}-{C} pattern. I have tried to label waves of the fall since the top in wave {B}. The 78.50-77.30 band is the last of the hopes. Below that the bullish view though will not be negated but will be considerably postponed.

But keeping things simple, we can say that if the rise till wave label {B} was corrective it should be completely retraced. In that case we will trade below the low put in at wave label D. A falling dollar will mean increased purchasing power for the INR, may help to ease the inflation a bit.

The chart below shows the internals of the fall from wave label {B}. It certainly is impulsive and there is still some downside left before we may see a bigger corrective bounce.

|

| 5 Hourly Chart |

Friday, September 07, 2012

|

| Daily Chart |

Similar to Nifty I have been talking about the support zone for Banknifty of 9900-9675. Yesterday we tested that level, and today we have rejected it, with a strong gap up. The indicators are poised for an up move. The count so far is that of an impulse, and right now we are embarking on wave III of {C}.

But to achieve this we will need stellar performance from all banks, public private alike. ICICI, HDFC, SBIN should take the lead, and show the way to other peers. A broad based rally of all the sectors in the market would really help.

|

| Daily Chart |

Nifty had a huge gap up today, there might be some compelling news item flashing on the screen of Business News Channels or may be not. But we had every reason to anticipate an up move from the 5215-5200 levels. We had discussed this possibility plenty of times in past few days, and finally we got what we wanted, we have now broken out of the falling channel of wave [b] or IV? as per the alternate count. We should now rise in wave [c] of III or wave V? as per the alternate count. But how do we make out which count is playing out here. The answer is quite elementary.

Both the counts are suggesting that we should see higher prices in coming days. But in case of our alternate count, we can see that wave III? is shorter than wave I, which means wave V? cannot be longer than wave III? (recall the "3rd" wave is never the shortest rule of EWP). SO by projecting wave V? == III? we get a target level of around 5630. Which means if we are in wave V? we cannot break out above this level of 5630, and that mean we will be forming a truncated wave {C}.

On the other hand our preferred count suggests that we are actually in wave [c] of III, which can end in the vicinity of 5630 or even go above, that will make our wave III longer than wave I, and then we can look forward to waves IV and V.

What are the trading implications then? Well we should be very very careful of the price action once we near 5630 levels. I case of our alternate scenario, truncation in wave {C}, we will fall very sharply, and that may not give us much time to adjust. But if we cross 5630 then we can be sure that we are going to get at least another set of 3 wave up move in wave V.

So right now trail your SL till we near 5630, and once we reach there, watch the prices like a hawk for further development.

Thursday, September 06, 2012

|

| Daily Chart |

|

| 4 Hourly Chart |

|

| Hourly Chart |

These are hourly charts for Nifty and USDINR. On the Nifty chart we can see prices breaking out from a wedge like pattern, also we have bee trading in the support zone for some time now. If buying has to emerge in Nifty, it should happen in this range. If the breakout from the falling channel gets good followup we may see higher prices on Nifty in coming days.

The USDINR chart sports a completed 5 wave move, now labelled as wave {1} on the chart below, we may see some consolidation before we resume the trend. As you can see, the price pattern of (1)-(2)-{1} also looks like a 3 wave move. So price action following this pattern will decide what the larger trend is. Since we have been in this range for almost a couple of months now, its not easy to bet which side the breakout would occur. In the morning though, USDINR broke the 56 barrier only briefly, if we make another dash at it, after consolidating in wave wave {2}, we may get our much awaited breakout.

|

| Hourly Chart |

Note: It is a widespread belief amongst traders that there seems to an inverse correlation in USDINR and Nifty, as both move counter to each other, but there have been periods when both the counters have moved in unison, so well, as made almost to believe that there is a direct relationship amongst the two. I suggest you follow both separately and manage your risks properly.

|

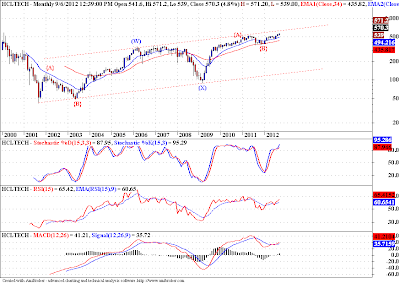

| Monthly Chart |

HCL Tech is one of the few stocks which is braving the down move in Nifty. While Nifty is moving sideways this stock is scaling new highs, the stock is at the highest levels in decades. But alas the move does not look like an impulse, in fact it looks like we are forming a DZZ since the low made in late 2001. Lets take a look at the wave internals on lower fractals.

|

| Weekly Chart |

The weekly chart above shows the the wave (Y) in detail. I am using a log scale so don't get the impression that wave {C} is very small compared to wave {A}. Yes it is around 50% mark of wave {A}. And I suspect it may top in between 61.8% - 50% mark of wave {A}, the range comes around 590 - 640. Right now we are trading around 570 odd levels.

|

| Daily Chart |

The daily chart shows the wave {C} in detail. WE seem to have completed waves I-II-III-IV and are currently in wave V, which might extend. The target for extended wave V comes at 600 levels where wave V == (0 - III). That sits pretty well with our target zone for wave {C}. Since we are dealing with very large fractals the target may vary a little, but the form so far looks like a DZZ.

Note: I wont pronounce this stock as a sorting candidate, but at least long term investors of those who were late to the party should think about protecting their accumulated profits and or capital.

|

| Daily Chart |

The above daily chart of Axisbank shows an uber bearish possibility, marked with alternate count. Our preferred count calls for a support in the zone of 945-890, we are there, but that does not mean anything by itself. Now what prices do in this area is important, if we take support and start rising, we may see our preferred scenario of an {A}-{B}-{C} playing out. But if we break down through these support zones we are in trouble, the alternate scenario of a 1-2/1-2/1-2 may be unfolding on the down side, and that would be disastrous.

The indicators are surely oversold on daily fractal, but on weekly and monthly there is still plenty of room left on the downside.

This is a crucial time for banking stocks, the "short term strength" I was expecting is nowhere to be seen yet, but till these support zones are broken I am hopeful, if they do break down, I will have to reevaluate my analysis. Part and parcel of a trader's life.

Wednesday, September 05, 2012

|

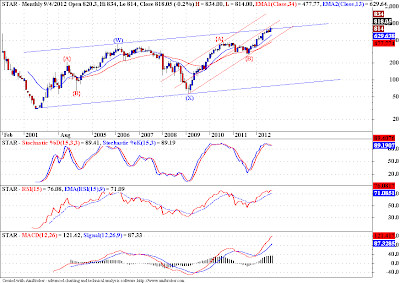

| Monthly Chart |

This is the best count I could fit on the chart of STAR (Strides Arcolab), I don't track this stock, so it may happen that I change my mind if price action demands it. But right now I can see 2 channels one blue one red and both the channels are suggesting that the near future is going to be difficult for this ticker. Both channels are offering resistance to prices, and since the whole rise was a corrective structure it should be completely retraced. Now that may be a scary thought and completely out of place at this moment, but that is what my preliminary analysis is telling me.

But once again I would like to state the fact that I don't track this ticker, and this count is subject to change if price action demands it.

The detailed count on lower fractals is shared below.

|

| Weekly Chart |

|

| Daily Chart |

|

| Bharti Weekly Chart |

Elliott Wave Analysis

Bharti has been suffering steep falls for past few weeks, the long term triangle scenario has been invalidated. We pointed out in our last post that we may see some support coming in the region of 250-220. Now again we seem to have completed a 5 wave sequence in wave I, and we can expect a rally albeit in 3 waves (wave II) to correct this impulsive down move from 450 odd levels marked as {II} on the chart above. If the pattern we are counting is right we may see further downsides once this correction is done with. I would not suggest long at this juncture, but if we see prices rising in 5 waves One can surely look to buy the next 3 wave correction, for a target in the range of 345-70.

Technical Analysis

- We have fallen hard after a Fast Fall setup.

- We have support in 250-220 range. Resistance around 310-345-370.

- ST and RSI are oversold on weekly chart, we can spot +ve divergences on daily chart. MACD is in bearish territory on weekly chart, but we can spot a bullish crossover on daily chart.

- We should see prices moving further up if we trade comfortably above 265 levels. SL would be 238.

- So for a gain of 107 points at 345 levels we are risking 27 points, that's a reward to risk ratio of roughly 4, and that not bad.

Sir Karl R Popper (28 July 1902 – 17 September 1994), Ralph N Elliott (28 July 1871–15 January 1948), Robert R. Prechter, Jr (b. 1949), Nassim Nicholas Taleb (b. 1960), George Soros (b. August 12, 1930), Jesse Lauriston Livermore (July 26, 1877 — November 28, 1940), some of the men I have never met (some passed away even before I was born) but have been greatly and deeply influenced by their work, fitting day to remember them, its Teacher's Day today!

|

| 4 Hourly Chart |

We have been discussing about the flag pattern in wave {2} on USDINR in our previous update, the said pattern did test our patience, but finally today the fag has staged a breakout. Now on the chart above our preferred count suggests that we may rise in wave (c) of [b]. In that case we may test the levels around 56.75. But for that we have to take out first the crucial resistance around 55.97 levels. As soon as we take that out we may see 56.75 on USDINR. I am keeping the SL for the buy trade on BO from the flag at 55.40. So you have a risk of 0.43 against a reward of 0.92, so the reward to risk ratio comes at 2:1, which is not bad.

Note: There are many possibilities at play, I have a tendency to play the most conservative scenario, to keep expectations realistic, and volatility of my trading portfolio minimum.

Tuesday, September 04, 2012

Nifty bearish channel can be seen on the chart above. If we break above it, we may see a start to a new up move, in wave V. The wave labels are not important right now, as we can look into them later if we catch the turn right. We are bang in the middle of the support zone, we have been discussing for a while now, the bearish channel is lining up pretty well. We might be forming a Fast Rise setup on Daily chart (5-13-34 EMA).

We can see positive divergences on all the 3 indicators on the above chart.

I would be going long on the break above upper channel boundary, with a SL below 5215-5200 range. On the upside we may see prices reaching even 5630, if our pattern is right (an ending diagonal in wave {C} of (B)).

|

| ICICI Bank Daily Chart |

Prices are strategically poised in the TAZ (13-34 EMA) on weekly time frame.

ICICI Bank is rising in wave C of {II}. If we close above 910-915 band, we may see prices rising from here, in wave [5] of C of {II}.

RSI is looking to take support around 40 that is a bullish sign. STS is oversold and it has already completed a bullish crossover. MACD signal line may be forming a ZLR. All 3 indicators above are suggesting strong prices if we get a followup soon.

The stop loss for this trade logically comes at the top of wave [1] around 864.20 levels. The target may range between the top of wave A at 998.80 and 1025. The Reward to Risk ratio comes around 2.5:1, which is not bad.

So f we close above the 5 DEMA around 910-915 range, we can buy into this stock with a SL of 864.20.

| |||

| Gold Daily Chart |

Both the precious metals are getting more precious by the day. But how long is this rise in prices of Gold and Silver expected to continue. I say not very long but of course in duration, not in magnitude. We know that 5th waves in commodities are driven by fear of inflation, unlike in stock market 5th waves the controlling emotion is greed. So what now, as was discussed earlier, both Gold and Silver are breaking out from triangular consolidations, and that is always good news because the thrust as is evident from charts is more often than not swift and the magnitude can be forecast pretty accurately using EWP guidelines. Both Gold and Silver are in the wave (3) of [5] of the thrust from the triangle, hence are evidently very dynamic (aka sharp). For Silver though the minimum target for the thrust is the top of wave [3], around 66893, for Gold it is difficult to say anything at this moment, but the price rise in Gold may continue til we reach the upper channel boundary. All in all the situation is looking bullish for precious metals, and so is the case with Crude, which we are discussing regularly on this blog. We can get broad picture for an market using EWP, the internal details can be found out by tracking these markets on even smaller fractals, and looking for low risk opportunities to enter this trend.

|

| Silver Daily Chart |

Monday, September 03, 2012

|

| Daily Chart |

Four things happening in Nifty right now, which indicate a possible reversal. We cant be too sure about it though, but being prepared is advisable.

No1. Nifty approaching lower channel boundary, may take support.

No 2. RSI approaching 40 levels, if it turns from 40 its bullish.

No 3. STS is oversold, and may be turning. A crossover over signal line would indicate further strength.

No 4. MACD is approaching "0" level, may be forming a ZLR (zero line reversal).

All 4 conditions above indicate strength in near future. A break below the lower channel boundary may cancel the party for the bulls.

|

| Hourly Chart |

Banknifty is falling impulsively, in wave [c] of II?. This is our preferred count so far. The wave (4) is taking a shape of a triangular correction. It alternates well with a zigzag in wave (2) of [c] previously. Once these waves (4) and (5) are done, we might resume the up trend. I am looking for support in the 9900-9675 zone.

|

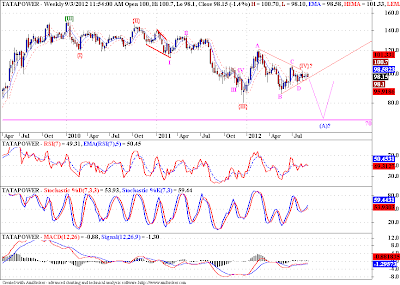

| Weekly Chart |

Tatapower is falling since the top made in Jan 2010. Initially I was under impression that we are in a 3 wave counter trend move, and the whole correction might take the shape of a flat correction. But subsequent price action is suggesting something different. As shown in the above chart, there is a good possibility that we might be forming a triangle in wave {IV} and actually there might be one more down leg remaining, towards the 70 levels. A break of the B-D trend line will be initial warning that the downtrend has started, further credibility will be added when we take out the low of wave D at 92. The invalidation level for this count is 103.

|

| Daily Chart |

Of course I am going to discuss an alternate count, because I am more worried about protecting my capital than increasing it. Because if one stays long enough in the game, one would get the knack of it.

Anyways the alternate count puts the recent consolidation as a triangle in wave {B}. Which means we should be rising back up once this triangle resolves. 92.05 is the invalidation level for this scenario. All the indicators are hovering around zero or 50 levels, which again is the sign of prices trading in a narrow range. But this range will resolve and will result is a trad able move.

I would suggest patience till we get a resolution of this trading range, and then take a call. If we stick to tight to our own view, rather than looking at what the charts are showing us, our trading actions will get biased, and that is not a good trait for a trader.

Saturday, September 01, 2012

|

| Crude Oil Daily Chart |

Crude is rising impulsively, one of the scenarios calls for a top in the 5500-5650 range on Crude. That is the scenario of wave (5) of [5] extending. Whereas according to the alternate scenario wave (3) may be subdividing. Both these scenarios call for further price rise in the Crude prices.

|

| Gold Daily Chart |

I don't track Gold, but i could not but help myself from spotting a triangle pattern completed in Gold, marked by wave [4]. Now What followed the triangle resembled an ending diagonal. But since we have taken out the top of that ending diagonal, we can expect further upside in Gold. The ending diagonal actually turned out to be wave (1) of [5]. Gold seems to have some more upside left in it. But as a precaution we should be cautious at 32065 on Gold spot. The reason for this possible resistance is, a triangle is spotted in fourth, X and B waves. Of which waves 4 and B should result in an impulsive move, but wave X is often followed by a zigzag in a double or triple zigzag combination. But if we take out the 32065 levels with ease, we can be sure that this up move is going to be an impulse.