- On the weekly fractal, KST has crossed over into the bullish zone, above the neutral level. Generally signals higher prices.

- Both MFI and ROC seems to be forming long term basing structure.

- ROC gave a BO but came back into the range.

- MFI signals that, participation is rising on rallies and falling on corrections.

- A Falling TL break might just be the signal which was required to confirm an end to this prolonged correction. But now we need followup.

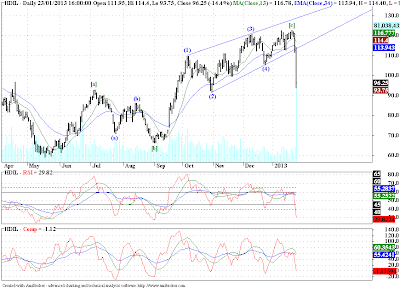

- An EW perspective on this counter suggests we may be in the 1-2/1-2 formation. The supporting evidence is RSI, is right in its Bull Support Zone. Now should RSI break down straight through this zone marked by dotted lines on the RSI panel, we may as well conclude that the correction is still not over.

- The second wave (2) may not have completed yet, and also this count is not definitive. There is a possibility that this 1-2/1-2 might just turn out to be an A-B-C.

- In that case, what we are considering to be a second wave of one smaller degree, may just be the start of a long down move, following a completion of a 3 wave corrective rally.

- So though the picture is exciting for the bulls it might be a good idea to wait for all the pieces to fall in place, before initiating a trade.

- Prices seems to be contracting (courtesy Bollinger Bands).

- MFI suggests a dramatic fall in participation with a steep decline, but prices have staged a 3 wave corrective rally at the same time. Overall this might be construed as bullish.

- ROC as obliged the price and is falling, after getting resisted under a rising TL.

- Now the BO from the new falling TL may give us an advance signal of a possible resumption of this up move. If supported by a rise in participation (a.k.a a BO above the falling TL in MFI), would add that much more credibility to bullish scenario.

- RSI broke out above a falling TL. But prices "HAVE NOT" confirmed the same.

- Prices should BO above falling TL, to confirm the signal given by RSI.

- Again prices are contracting, as shown by the Bollinger Bands.

- MFI is rising with firm prices and falling with falling prices.

- ROC and MFI have formed positive divergences.

- All signs of higher prices. If confirmed by prices, if they trade above the EMA of the Bollinger Bands.

- Now the final nail in the coffin. An Inverse HnS, "MAY" be forming. Clearly if prices trade below the low marked by H, this scenario is negated.

- But in strong support to this scenario is the RSI TL, which has been tested 4 times , and if respected should result in an up move in prices. (Though the fractal is a small one only 10 min).

- KST is making higher highs and higher lows.

- ROC has formed a base just below the neutral level. If we get a BO this could be bullish in the very near term.

- But his near term strength may help us stage a BO from the HnS NL, and to ring in more buyers.