|

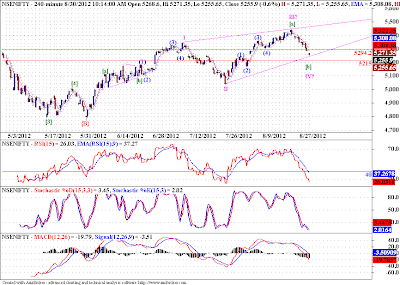

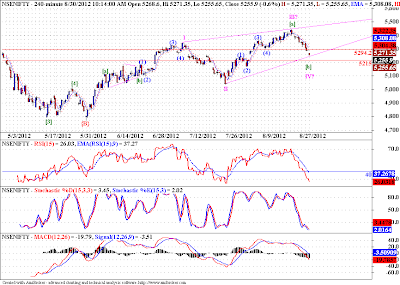

| Hourly Chart |

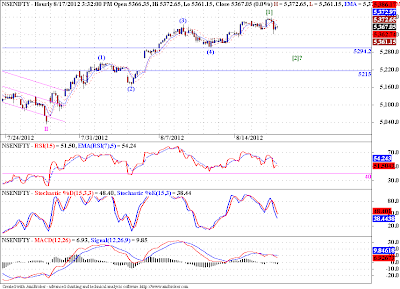

Banknifty is approaching the PRA (Possible Reversal Area) between 9900-9675. We are looking good to complete a clear 5 wave structure too. Will this index turn up from this PRA. Well we can use channeling technique on this zigzag correction in wave II, and we get the lower channel boundary in the same PSA. If we bounce off the lower channel boundary, then we may have a potential reversal at hand.

![Crudeoil headed to conquer wave [3] top around 5500 levels!](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgc7juDISVlAFBv2z6VHQaBoyrS_wr9m-MBImH10xiU9TBzspCbNGMTErOj4zoqF8xi6N7BbMXKr7GqQ5R-Gqg5frEOycQI1pkC76jZp66mEoGQtarANVo_QzSWONnp_K7as9D9APEX6jH8/s320/Crudeoil.png)