|

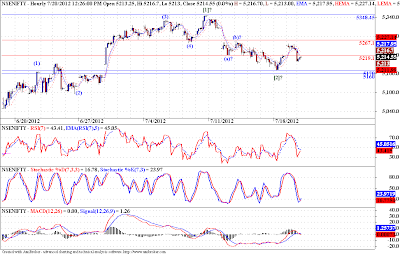

| Nifty |

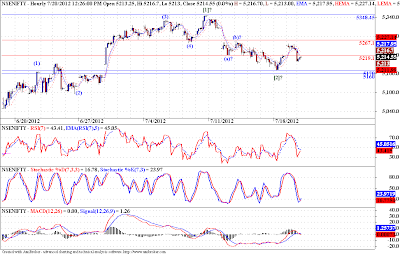

Nifty is sharply down today, if we agree that there is some correlation between Nifty and USDINR, then a sharp decline in USDINR should result in a rise in equities. Now the short term wave count suggests that Dollar may weaken further and in response, equities should rise, that has been my underlying story for a while. Now if this scenario plays out we will see much higher prices, at least we should reach 5630, that's a minimum requirement. The recent price action fits well into a channel, and a break down from this channel, will confirm the 3rd wave down in USDINR.

|

| USDINR |

Dear Aniduddha

ReplyDeleteplease consider the fact that Nifty moved up from 4770 to 5269 which in this period INR was down from 53 to 56

thanks

"if we agree" - That's the catch phrase. I am not a big fan of correlations. I just pointed out common wisdom. But I do feel Nifty should rise, and USDINR should fall.

DeleteRegards

Aniruddha