Nifty gapped up today, and is comfortably trading above the 5225-30 range, we mentioned in our

last post. Now the next hurdle, or shall we say the next confirmation of an up move will come above, 5260-70 range, as already envisioned in our

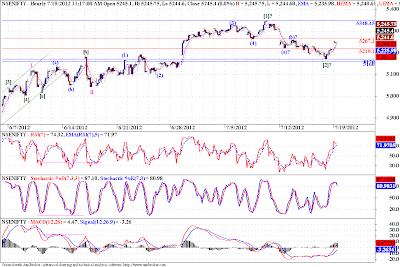

last post. Now shall the Nifty take out these levels, we will see further upsides from these levels. The weekly STS and RSI should turn up. MACD on weekly time frame, is pushing the 0 level, if it manages to cross above that, it will mean that prices are gathering momentum on the up side, which should help our cause. On the hourly chart above, we can already see MACD crossing above the 0 level, it should now sustain above it, for continued trend on the hourly time frame. On the daily chart, the picture is most encouraging for our medium term strength in the prices. I suggest once again to keep the SL at the 5170-60 band, and wait, sit tight unless the markets come down decisively and topple you (a.k.a hit your stop loss).

A wise trader Jesse Livermore has said "Its the SITTING that makes you the money!", I say, "EWP prevents us from being DUCKS!" |

| Daily |

No comments:

Post a Comment

...I am thrilled to learn what you think about this piece of content...