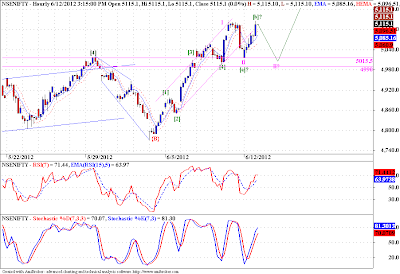

I have tried to put the market action in perspective, with a couple of possible wave counts. My preferred count suggests that we have completed the wave II at 5015, and now are on our way to the wave III. Any pullbacks here onwards should be bought into, and there is a good chance that they will show as intraday pullbacks on hourly chart, and wont reflect at all on weekly charts or daily charts. But my alternate count suggests that we might have wave [c] of II still pending, and may retest the 5015 - 4990 band once again before embarking on the dynamic third wave. If our alternate scenario plays out, we will get a good entry point in the range mentioned above. But yesterday's pullback satisfies all the necessary requirement of a second wave. If we gap up tomorrow, any intraday pullback should be bought into, to take the benefit of the dynamic wave III.

Tuesday, June 12, 2012

Nifty - Elliott Wave Analysis

Tags

# Elliott Wave

# Indices

About Dean Market Profile

Dean is a fulltime trader for last 13 years. He is passionate about technical analysis. His instruments of choice are Nifty and banknifty futures and options. His main analysis and trading tools include advanced techniques like Market Profile, Voilume Spread Analysis and Order FLow Analysis. Dean is a teacher at heart and loves sharing his learnings with committed traders. You can check out his courses here...

Nifty

Categories:

Elliott Wave,

Indices,

Nifty

Subscribe to:

Post Comments (Atom)

Hi Aniruddha.

ReplyDeleteApart from C of Expanded Flat.

I'm looking towards Expanding Triangular Correction ABCDE

My Counting is Little Different

I have two Alternates wave 2 or B

You can Check Here

http://trend-o-nomics.blogspot.in/

Thanks & Regards,

Harsh Dixit.

I am looking for a consolidation as well followed by a rise. So it could be your a-b-c or a third wave. But indeed if prices come down it would be a good buying opportunity. Although my downside target is around 4990.

DeleteSir Jii can you please comment on Larsen & Tubro .....shrikant.bhosale@rookline.com

ReplyDelete