|

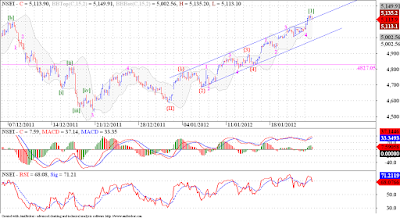

| Hourly chart |

Nifty broke above the upper channel line but around the close it came down and closed below the channel line, typical development for a 5th wave extension, called a 'throw over'. Such a development suggests an end to the impulse wave under consideration, but will Nifty follow our analysis? That remains to be seen. But if we have completed this 5 wave move, with wave {5} extension then we can expect the correction to this move reach rapidly to the wave 2 of extended wave {5}, and further to the wave {4} of this impulse wave, the range comes around 4900 - 4800 levels. Let us now observe if we get the next 300 odd points to the down side, stop loss for any shorts should be above today's high. Below 4850 this view gets added confirmation.

Wave count from 4827 onward the 3rd seems to be the shortest which is not possible.

ReplyDeleteThe orthodox end point of wave 4 which is a triangle is at 5040.65, so if this count is to be invalidated we have to cross 5165 where this count will be violated.

Deletecrossed 5165. any changes?

ReplyDeletePlease refer today's post.

Delete