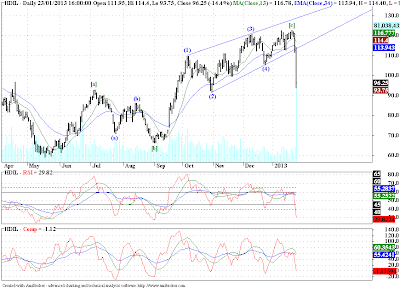

- HDIL seems to have completed a 3 wave counter trend move, as is obvious from the sharp fall, once the final rising wedge (ending diagonal) was complete. Any 3 wave bounce should be sold into, I guess.

- The breakdown has reached its target (target for the ending diagonal wave (2) low) in practically 2 days, that is sign that the prevailing down trend has asserted itself, and how.

- M&M on the other hand has been trending beautifully. But as with everything else, all good things must come to an end.

- Whether M&M has completed its 5 wave advance at 975 odd levels, only time will tell, but it could well be the time to be cautious.

- The best strategy would be to watch the price moves closely, if we rally in 3 waves and fall back to make new lows, the trend could be considered bearish for some time to come. The whole advance from 620 odd levels, stands to be corrected.

- There is also a possibility that the correction might be a shallow one (look for the wave (4) of one lower degree to offer support), and the last of the advance the final wave [5] might still be pending.

Note: This discussion was in response to a direct query from a Blog Reader. Thought everyone might find something useful out of it. Just a thought!

No comments:

Post a Comment

...I am thrilled to learn what you think about this piece of content...