|

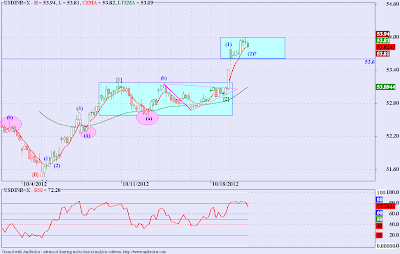

| USDINR Hourly |

USDINR broke out of a consolidation and gave a big move (notwithstanding my earlier post). And this move should continue for a while. Another consolidation seems to be emerging with lower boundary at 53.60. We may see another move up soon.

RSI as can be seen has remained above 40 for most part of this up move and consolidation. And if this move continues we should remain in the 60+ zone to see some accelerated moves, ahead (Thanks to @ranajayb for the RSI article, but whether my interpretation is correct or not, only time will tell). As soon as the longer EMA (Green Color) catches up with price, we should see another big move.

Hi, i think you intepretation of elliott-wave is abit wrong. Firstly, you label the price on 04 oct as wave {II}, which means wave {I} started from 31st OCT 2011 last year till mid june this year i guessed thats what u think. And so after the high hit on mid june, this pair goes into a wave {II} recovery. Here is the issue. Based on Classical Elliott wave principle i studied, recovery wave in wave {II} normally is Zig-ZAg (5-3-5) movement, which is based on the price action from Mid june till starting of Oct. However, using Fibonacci Guide, it did not retrace at least 50% at all. Based on 50% retracement, the target price for wave {II} should be 50.57. Secondly, u labeled the price from 04 oct to 10 oct high as wave i? It look more like a WXY formation to me. And for wave ii, how could it be in that way? The price action after 10 oct to 17 oct looks more like consolidating Triangle. Again, the RSI looks to me more like consolidating. As of today, the price had hit 54 before dropping off till 53.20 - 53.30 support. Its kind of sharp retracement to me, hence i determine that the price from 04 oct till last friday high should be a WXY movement, typical for wave 4 movement since if i intepret that the price from mid june till now maybe an impulse 5 wave decline, typical for a wave a corrective movement after upward movement.

ReplyDeleteAs for your case of USDINR will move higher, perhaps you are lucky becos Gold is been sold off hard since last week till now amid US dollar strength. If thats the case, perhaps even USDINR movement is not really its fundamental movement, but rather speculative, and will correct itself. As of this mth, Gold and USDINR correlation is still there, so if gold drop off, USDINR rallies. Since today some are not trading to reflect their fundamental, that means price action maybe sometimes "just to scare or fake u out".

All and all, just be mindful of what u write, becos proving yourself correct does not prove anything. [i.e (Thanks to @ranajayb for the RSI article, but whether my interpretation is correct or not, only time will tell).]

Thanks for your comment!

DeleteThis blog is for sharing my understanding (or the lack of it) of wave principle. It is not compulsory to read this blog, you are free to while your time the way you like.

I could not understand your analysis of USDINR, because I am bad with numbers, but if you could be so kind to mark your count on a chart and take the pains to mail it to me, I would be very glad, and could use your suggestions, to check my analysis.

Also I don't take whatever I have learned too seriously, to find out the reason you would have to read Karl Popper. So I have no incentive in being correct in my forecasts, I have a strong trading plan to take care of the eventualities when my analysis is wrong, and that is what I have always recommended to the readers of the blog.

As far as my comment "(Thanks to @ranajayb for the RSI article, but whether my interpretation is correct or not, only time will tell)" goes, you have misinterpreted it, Ranajay is a mighty fine analyst, and I can only learn from him. This blog has never so far and never will in the future undermine a fellow analysts work.

Ans lastly I being lucky is good, very good for me. Because I would rather be lucky in this randomness prone environment we work in called the "MARKETS", than a Guru!

Regards

Aniruddha